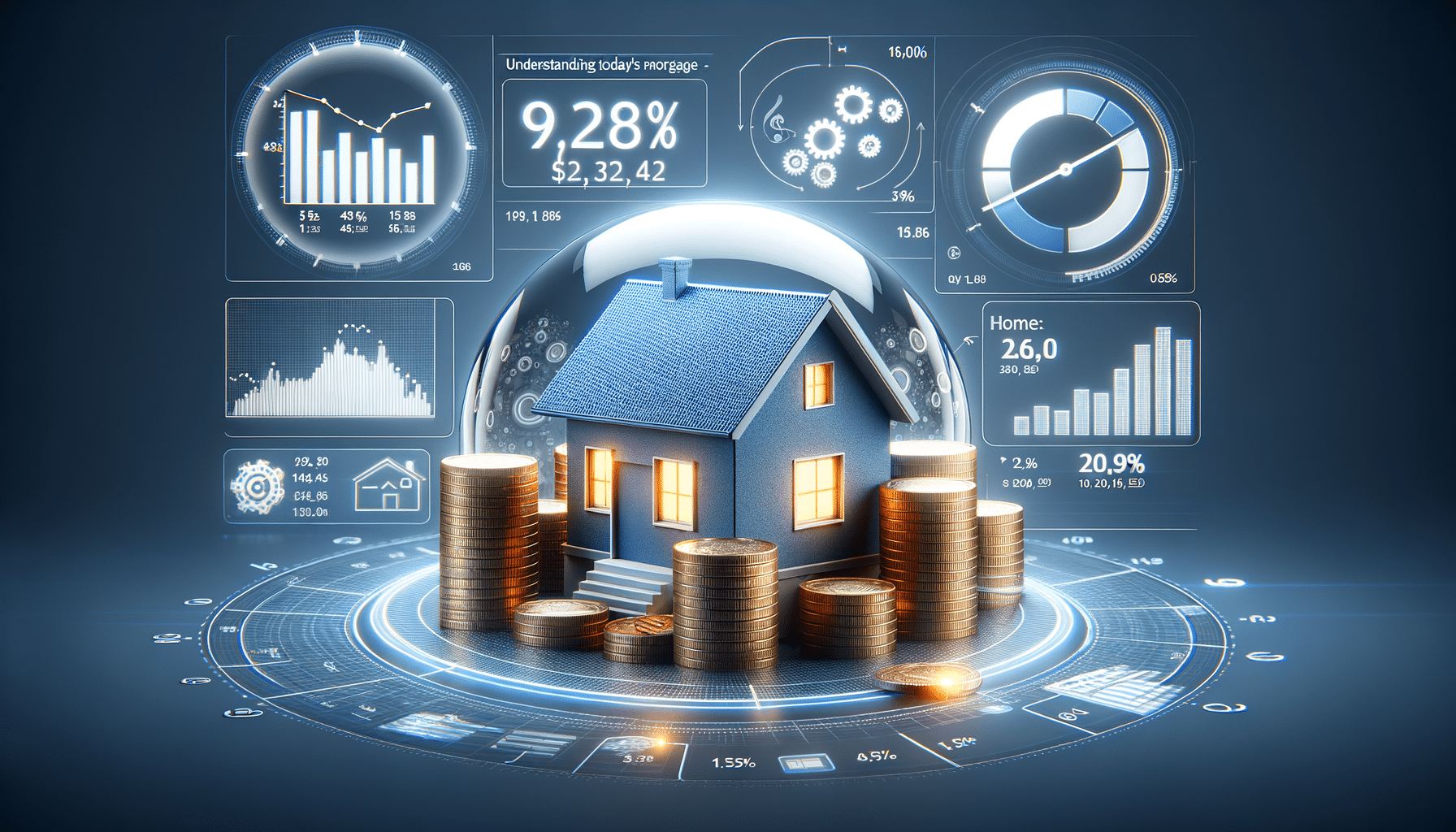

Understanding Today’s Mortgage Rates: A Comprehensive Guide

Introduction to Mortgage Rates

Mortgage rates play a crucial role in the home buying process, influencing both affordability and long-term financial planning. Understanding the factors that determine these rates can help potential homeowners make informed decisions. As economic conditions fluctuate, so do mortgage rates, making it essential to stay informed about current trends and forecasts.

Factors Influencing Mortgage Rates

Mortgage rates are affected by a variety of factors, including economic indicators, inflation, and the Federal Reserve’s monetary policy. Economic growth often leads to higher interest rates as demand for loans increases. Conversely, during economic downturns, rates typically decrease to encourage borrowing. Inflation also plays a significant role; higher inflation usually results in higher rates to maintain lenders’ profit margins.

Moreover, the Federal Reserve’s actions, such as adjusting the federal funds rate, directly impact mortgage rates. When the Fed raises rates to curb inflation, mortgage rates often rise in tandem. Other factors include the bond market, as mortgage rates tend to follow the yield on the 10-year Treasury note, and the overall supply and demand for housing.

Types of Mortgage Rates

There are several types of mortgage rates available to borrowers, each with its own set of advantages and considerations. Fixed-rate mortgages offer stability with a constant interest rate over the life of the loan, making them a popular choice for long-term homeowners. Adjustable-rate mortgages (ARMs) start with a lower rate that adjusts periodically based on market conditions, which can be beneficial in a declining rate environment.

Additionally, interest-only loans and balloon mortgages provide alternative options for specific financial situations. These types of mortgages can offer lower initial payments, but they come with risks if not managed carefully. Understanding the differences between these mortgage types is crucial for selecting the right loan for your financial goals.

Current Trends in Mortgage Rates

As of today, mortgage rates continue to be influenced by a complex interplay of global economic factors and domestic policies. Recent trends show a slight increase in rates due to rising inflation concerns and the Federal Reserve’s indications of future rate hikes. However, the housing market remains competitive, with demand often outpacing supply, which can keep rates from rising too quickly.

Prospective homebuyers should monitor these trends closely, as even small changes in rates can significantly impact monthly payments and overall loan costs. It’s also important to consider the potential for future rate adjustments, especially if opting for an ARM.

Strategies for Securing Favorable Mortgage Rates

Securing a favorable mortgage rate requires strategic planning and a thorough understanding of the lending landscape. Here are some tips to help you achieve the most advantageous terms:

- Improve your credit score: A higher credit score can lead to better rates, so take steps to pay down debt and correct any inaccuracies on your credit report.

- Shop around: Compare offers from multiple lenders to find the most competitive rates and terms.

- Consider a larger down payment: A substantial down payment can reduce the loan-to-value ratio, potentially resulting in a lower interest rate.

- Lock in your rate: Once you find a favorable rate, consider locking it in to protect against future increases.

By taking these steps, you can increase your chances of securing a mortgage that aligns with your financial objectives.